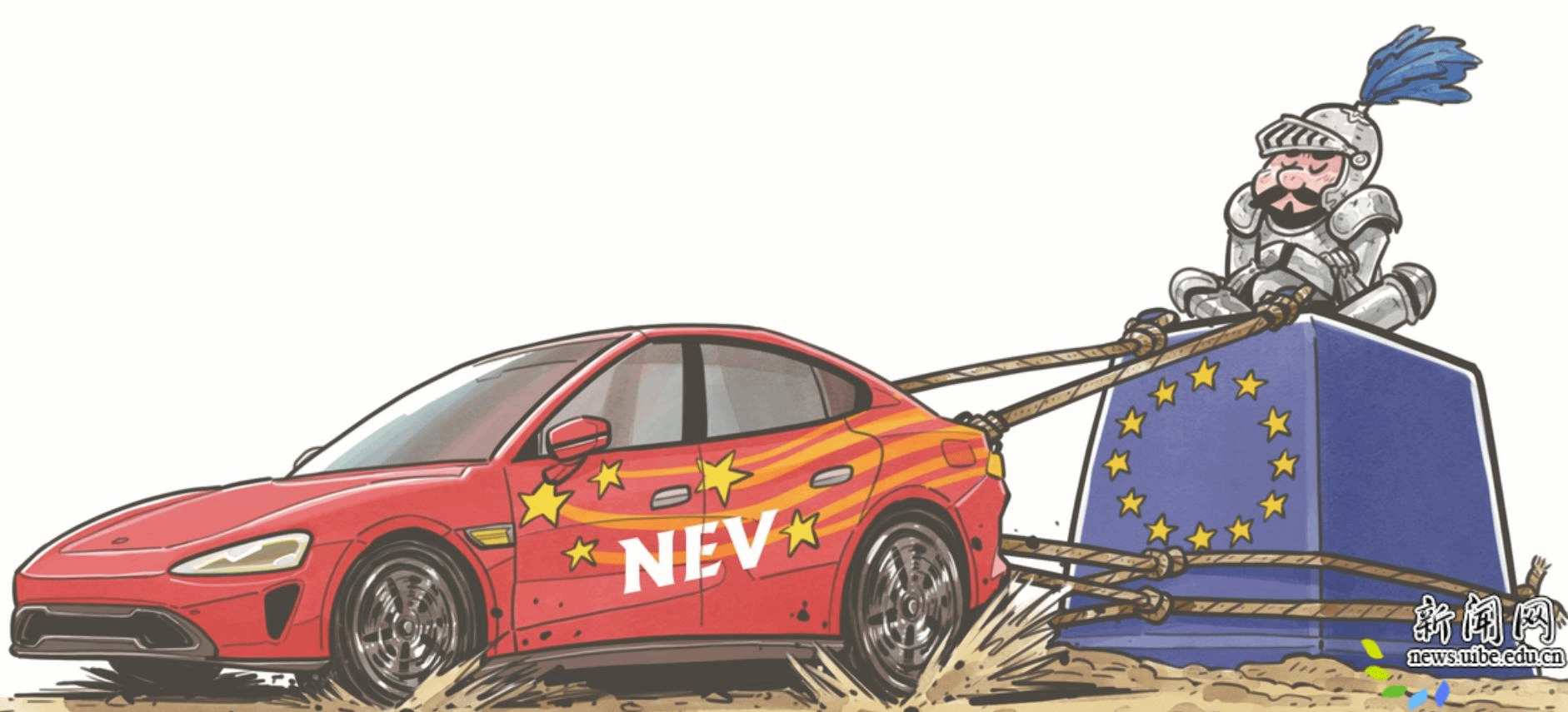

CAI MENG/CHINA DAILY

Two recent events have indicated escalating trade tensions in the clean-tech sector.

On May 14, the United States said it would significantly increase, from Aug 1, tariffs on a range of Chinese exports, mainly clean-tech products such as new energy vehicles (100 percent), solar panels (50 percent) and lithium batteries (25 percent).

On June 13, the European Commission announced the preliminary results of its ongoing investigation into so-called Chinese NEV subsidies, concluding that China's NEV value chain benefits from "unfair subsidization" that hurts EU rivals, and planning tentatively to impose extra tariffs ranging from 17.4 percent to 38.1 percent on NEV exports from China.

Indeed, the underlying rationale for the (countervailing) tariffs on China as advocated by the EU is highly similar to that of the "overcapacity" (or, more accurately, the "predatory overcapacity") allegation of the United States, both claiming that China's competitiveness in clean-tech products in general, and NEVs in particular, derives from the subsidies they receive, thus constituting predatory pricing, resulting in flooding of exports to the detriment of relevant industries in importing countries.

The argument, however, is highly misleading, if not unfounded.

Even US Treasury Secretary Janet Yellen admits that "overcapacity" is "a complicated issue that involves China's entire macroeconomic and industrial strategy". Admittedly, there may be some sign of overcapacity in some clean-tech sectors, but this is far from "predatory overcapacity" backed by industrial subsidies, as the US asserts, and the competitiveness of Chinese clean-tech industries is not bolstered by industrial subsidies, but by the dynamics of China's factor endowments at this stage.

To industry insiders, those signs of overcapacity are more likely to be the product of a boom-bust cycle driven mainly by spontaneous market process, as relevant industries are entering a mature phase in their respective technology/product life cycles.

For example, in the case of NEVs, for the past 20 years, Chinese companies have been making early strides in this field in a systematic manner, making substantial R&D investments successively, and gradually building up their unique technological edges.

Moreover, China has a huge market; its sustained investment in STEM research and higher education has ensured a steady stream of the so-called "engineers' dividends"; rich application scenarios, full-fledged competition (even to the extent of so-called "involution"), and frequent interactions between the supply and demand sides and among relevant participants have all enabled an ongoing optimization of the value chain ecosystem.

Through years of competition and cooperation (including cooperation with foreign companies), a highly cost-competitive, efficient and comprehensive NEV supply chain has gradually taken shape in China. In short, in the NEV industry, China is increasingly demonstrating a clear comparative advantage, consistent with the dynamics of its factor endowments at this stage.

In fact, over the last decade, thanks to the technological, manufacturing and engineering progress of Chinese companies, the global average costs of wind/solar power generation and lithium batteries have fallen significantly, making a significant contribution to the global transition to green and low-carbon energy.

Against the backdrop of the global energy transition and after years of development, the NEV, lithium battery and PV industries have so far entered the mature phase of the technology/product life cycle. In this phase, a dominant (technological) design emerges, and the market becomes commoditized. Accordingly, the competition increasingly revolves around price, and there is usually a shakeout, characterized by large-scale capital investment (in the dominant technology/design) to grow volume and bring down costs, leading to fierce price wars and the exit/consolidation of competitors.

Overall, an industry in this phase often exhibits signs of overcapacity, which is the natural result of industrial development driven mainly by spontaneous market forces.

The consequence of protectionist measures that unfairly target China will only result in the shift of production from a low-cost (more efficient) country to a higher-cost (less efficient) one.

As Singaporean scholar Lance Gore sharply pointed out, Yellen's argument "is practically saying that the US cannot compete with China's 'new trio' but the US workers' livelihoods must be protected, so production capacity must be allocated, and the benefits shared".

Meanwhile, these recent events have shown that the Sino-American trade disputes have further spread to clean-tech sectors closely related to climate change. However, China-US cooperation on climate change has long been viewed as a special bond that helps to stabilize the relationship between the two countries during difficult times.

Moreover, another major global geopolitical player, the EU, has also become involved in trade tensions with China, which adds to the geopolitical complexity that China faces.

If trade disputes over clean-tech products continue to escalate, the foundation of trust for China-US climate change cooperation (and also for that between China and Europe) will be undermined, impeding any further substantive climate cooperation between them and making it much more difficult to achieve global climate change goals.

On a more practical level, disruptions in the supply chain of clean-tech products will slow down the deployment of renewable energy projects worldwide, affecting efforts to combat global climate change.

In the process of readjusting/restructuring the global new energy industries, it is necessary for all major global players to effectively communicate and cooperate with each other to jointly address global challenges and put the world economy back on track.

As Stephen Roach put it bluntly, "to take a protectionist stand against a country like China — that has a comparative advantage in producing the non-carbon, alternative energy products that a world in the grips of climate change desperately needs — is a blunder, potentially of historic proportions".The author concurs.

The writer is president of the University of International Business and Economics.

中文版:

产能过剩?并非如此,发展使然。

对外经济贸易大学 赵忠秀

最近发生的两起事件足以表明清洁技术领域的贸易紧张局势正在加剧。

5月14日,美国政府宣布 (Reuters, 2004),将自8月1日起,大幅提高一系列中国进口产品的关税,其中大多是清洁能源产品,具体有电动汽车 (100%),锂电池 (25%),太阳能电池板 (50%)等。

6月13日,欧盟委员会 (2024) 宣布了对中国电动汽车补贴调查的初步结果,认定中国电动汽车“价值链” 受益于 “不公平补贴”,损害了欧盟竞争对手的利益,并初步计划对从中国进口的电动汽车加征17.4 至38.1% 的临时关税。

欧洲所主张的对中国加征关税的基本依据,与美国所谓“产能过剩论”(更准确地说,是“掠夺性产能过剩论”) 高度类似。 这两种观点都主张,中国清洁技术产品,特别是新能源汽车的竞争力,来自于其获得的补贴,并因此构成掠夺性定价,造成中国产品出口激增,损害了进口国的相关产业。对于中国的这种指控,具有很大的误导性。

应承认,产能的恰当性是个复杂的问题,在中国新能源产业的某些领域,可能存在某些产能过剩迹象,但它远不是美方所指的由产业补贴支撑的“掠夺性产能过剩”,其竞争力也并非来自产业补贴的支撑,而是由本阶段中国要素禀赋的动态特征支持的。 而那些产能过剩迹象,则是相关产业在逐渐进入成熟阶段后,由自发市场进程驱动的繁荣-萧条周期的产物。

以新能源汽车领域为例,自从20多年前开始,中国企业就在该领域提前布局,对研发进行持续大量投入,并逐渐累积起独特技术优势。 此外,中国市场规模巨大;多年来对STEM研究和高等教育的持续投入,保证了稳定的工程师红利;丰富的应用场景,充分的竞争 (甚至达到所谓 "内卷化 "的程度),以及供需双方以及价值链上的各种参与者的频繁互动,使价值链/供应链的生态持续优化。 在多年竞争和合作 (包括与外资企业的合作), 中国逐渐在该产业形成了极具成本竞争力的、高效、完备的供应链。 简而言之,在新能源汽车产业,中国日益体现出明显的、与其此阶段要素禀赋动态特征相吻合的比较优势。

在过去的十年里,得益于中国企业在技术、制造和工程方面的进步,全球风力/光伏发电和锂电池的平均成本都已大幅下降,这为全球向绿色低碳能源转型做出重要贡献。

在世界性能源绿色转型的大背景下,经过多年发展,新能源汽车,锂电池和光伏产业已逐渐进入产品/技术生命周期的成熟阶段。 在该阶段,主流技术路线日益明确,市场趋于标准商品化 (commoditized)。相应地,竞争日益围绕价格展开,通常会发生产业重组,其特征是通过大规模资本设备投资以提高产量和降低成本,这又进而导致激烈的价格战以及竞争者的退出和整合。 总体而言,处于这一阶段的产业通常会表现出某种产能过剩特征,这可以说是产业发展的一般规律,主要由市场自发力量驱动。

那些错误地瞄准中国的,极具保护主义色彩的措施,其后果只是将生产从一个低成本(效率较高)的生产国转移到成本更高(效率较低)的国家。

正如新加坡学者Lance Gore(2024)一阵见血地指出的那样,耶伦的论点 “实际上是在说,美国无法与中国的“新三国”竞争,但美国工人的生计必须得到保护,因此必须分配产能,分享利益。”

与此同时,我们也注意到,这两个事件也表明,中美贸易冲突已进一步蔓延到与气候变化密切相关的清洁能源技术产品领域。 然而,长期以来,中美在气候变化问题上合作,一直被认为是艰难时期维系和稳定中美两国关系的特殊纽带。 此外,另一大全球性地缘政治参与者——欧盟——也卷入到贸易紧张局势中来,并且站在保护主义色彩浓厚的美国一方,这增加了中国所面临的全球地缘政治的复杂性。

可以预见的是,如果清洁技术产品的贸易争端持续升级,中美(也包括中欧)在气候变化方面进行合作的信任基础将被破坏,这可能会阻碍双方进一步开展实质性的气候合作,进而使实现全球气候目标变得更加困难。在更为现实的层面上,清洁技术产品供应的中断,也将减缓全球可再生能源项目的部署,影响应对气候变化的努力。

在全球新能源产业调整/重组的过程中,全球各主要参与者有必要进行有效沟通与合作,共同应对全球挑战,使世界经济重回正轨。正如斯蒂芬-罗奇(Stephen Roach)直言不讳地指出的那样 (SCMP, 2004),“对中国这样一个在生产非碳替代能源产品方面具有比较优势的国家采取保护主义立场,是一个潜在的历史性失误,而这些产品正是饱受气候变化困扰的世界所急需的”。作者对此表示赞同。

附原文链接:https://enapp.chinadaily.com.cn/a/202406/24/AP6678c68ea31066523d470246.html